5 Factors for Choosing the Best Housing Market in 2023

A key framework for selecting the best real estate market for investment.

Welcome to my new subscribers! Join 27,000+ with a weekly dose of wealth and wellness with WHealthier. It takes a second, and it’s completely free.

I recently watched an awesome presentation from Neal Bawa of Multifamily University. In it, he shares his data-driven framework for selecting the best housing market investments.

The video was quite insightful. Even if his data or model isn’t perfect, having a framework for finding cities that check all the relevant boxes can provide one with an upper hand in choosing a high-growth market over the next decade.

Note: This is mainly for single and multi-family. As many of you are aware, we are currently investing in Mobile Home Parks. We believe that it is a unique niche of affordable housing, for which demand will grow over time.

The limited supply of mobile home parks, and the fact they are nearly impossible to build and are constantly being replaced, make it akin to the Bitcoin of real estate. If you’re interested in learning more, feel free to reply to this email or send me a DM and I’ll share with you a deck about our latest park.

For now, I’m summarizing my findings from Neal’s presentation in this short post in the hope that it helps you better navigate the ever-changing landscape of real estate.

5 Factors for Selecting a Real Estate Market

First, look through these key factors to determine high-growth cities. At the end of this section, I’ll include a link to a spreadsheet with my research via Google Docs.

You can also ‘make a copy’ and add to it. All of the formulas are there so you simply need to insert the information.

Population Growth

A growing city means more jobs and more demand for housing. Aim for cities that have at least a 10.6% population growth from the years 2010 to 2020, or higher than 1% per year.

Simply Google “Population Growth for [City Name]” and you can easily find this data.

Note: Neal acknowledges that this data is a few years old. However, according to his research, the larger trend remains, and the newer data is not worth paying for as it does not alter the big picture.

Median Income Growth

Naturally, we’re looking for cities with strong income growth, as this will allow people to pay more for housing.

Aim for 35% median income growth between the years 2000-2019.

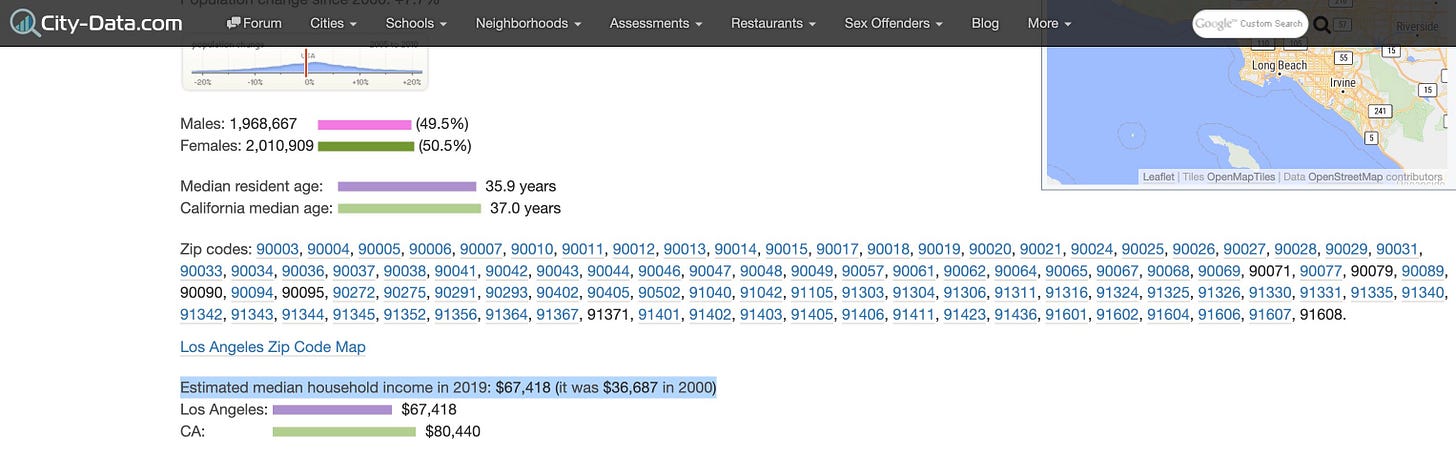

Use www.city-data.com to find the data for #2-#4. Simply copy the right number ($36,687 in the highlighted example above, which reflects the 2000 data) and paste it into the spreadsheet. Then do the same for the left number ($67,418, which reflects the 2019 data).

Median Housing Growth

We want cities with an established trend of housing growth over the past two decades.

From 2000 to 2019, aim for a minimum of 56% growth.

Crime Level

Low crime is important for creating demand. This statistic encompasses other stats, such as school quality, because the two are inversely correlated.

In other words, finding low-crime cities will automatically help you filter for other factors people value when choosing a place to live.

Seek cities with a crime index number below 450 (ideally below 400), and that have declined by 100 over the past 15 years.

12-Month Job Growth

Job growth drives population growth, which in turn drives home prices. Find cities with > 4% job growth over the past 12 months. If the city has a population greater than 1M, 3% is sufficient.

Note: This statistic only applies to the first half of 2023. For the second half, the numbers reduce to 3% and 2% respectively.

Source: www.deptofnumbers.com/employment/metros

Here is a link to the City Comparison Spreadsheet for 2023, courtesy of Neal. To help save you some research time, I have populated it with a few cities I’m targeting as well.

I hope this short post helps you better navigate the real estate market in the year ahead.

If the mobile home park niche interests you, let me know. Feel free to reach out with questions or to learn more about what we’re doing.

Which cities are your favorite?

Alec