Is Bitcoin Just One Giant Bubble?

A side by side look at Bitcoin compared to other historic bubbles.

In a recent debate between Peter Schiff and Richard Heart, Schiff argued that Bitcoin, and all cryptocurrencies, are one giant bubble just waiting to pop.

In essence, Schiff believes Bitcoin is a greater fools theory, and compared it to previous bubbles of the past, such as ‘Tulip Mania’.

I’ve been listening to Schiff for years, and believe he’s very smart, balanced, and a great investor. I agree with his macro thesis about the problems with the FED and central banking, the coming weakness of the dollar and well, everything except Bitcoin.

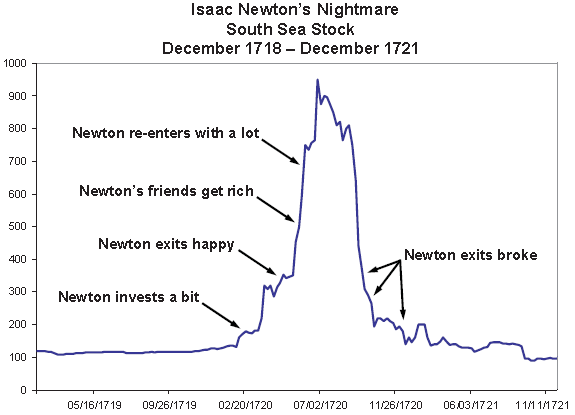

In any event, I wanted to take a look at previous bubbles and see how they performed relative to Bitcoin. Could it be possible that Bitcoin is just one giant bubble waiting to pop, and we’re all going to get rekt like Isaac Newton in the South Sea?

If you’re new here, my name is Alec Torelli and I’ve spent thousands of hours in crypto, DeFi and NFTs. My mission at CrypTorelli is to simplify crypto so anyone can understand it. I’ll also share the latest, most exciting opportunities in the space before anyone else. Join the thousands of others to stay up to date.

First, let’s take a look at this classic chart about the anatomy of a bubble.

Historically almost all bubbles follow a similar pattern. They inflate dramatically leading to exponential growth, then pop before returning to where they started. Notably, the price stays at these lows after the bubble pops, and never returns back to the previous high.

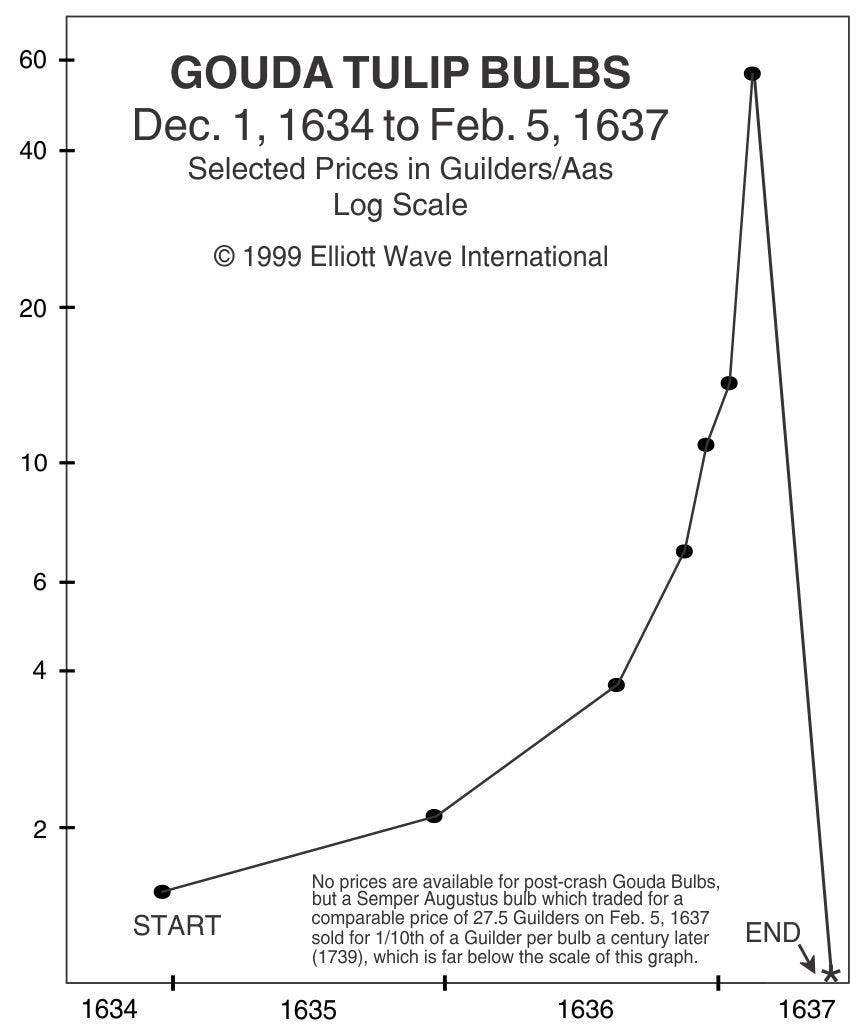

Here’s a look at two of them. First, Tulip Mania of the 1600’s. Notice the parabolic blow off top and return to near zero (the intrinsic value of a tulip). The price of tulips never returned to the price during the bubble.

Second, we have the South Sea bubble of the 1700’s.

Same graph as the tulips, but a different asset. Blow off top, followed by capitulation.

There are other examples of bubbles from history, but you get the point. Bubbles follow a predictable pattern, before returning to their original price before the hype, which is most often near zero.

Now, let’s take a look at the Bitcoin bubbles of the past, starting with 2011. Bitcoin went from $0.30 to $30, a 100x increase, before ‘popping’ and returning to extreme lows.

If Bitcoin were like other historic bubbles, the chart would end here, and it would continue to capitulate until prices neared zero.

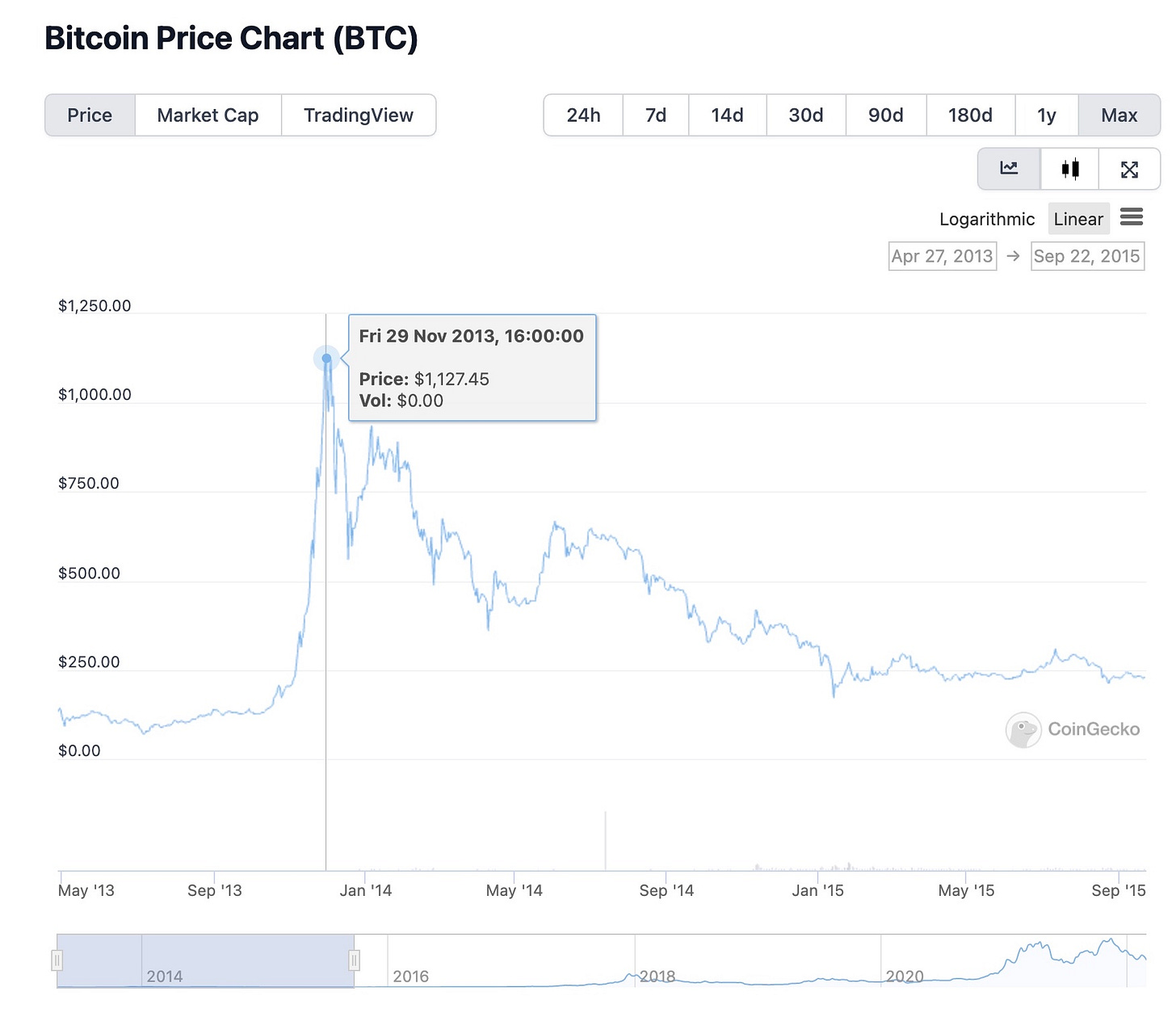

But that’s not what happened. In 2013, Bitcoin returned again.

The key distinction between traditional bubbles and Bitcoin is that all other bubbles have never reflated once they pop.

Right here, I believe Schiff should have updated his worldview about Bitcoin. What other bubble (which I’d define as something with virtually no intrinsic value) reflates 100x a second time after popping?

Is it possible that Peter Schiff is wrong about Bitcoin, and it’s in fact not a bubble, but a better form of money than gold, and hence why cryptocurrency is the fastest technology to be adopted in history?

Surely a bubble with no intrinsic value wouldn’t be able to survive a second 100x reflation, but that’s exactly what happened. Here’s Bitcoin again in 2015.

Each one of these Bitcoin bubbles looks exactly like the Tulip Mania and South Sea bubble before it, yet the cumulation of them implies that Bitcoin is unlike these other bubbles because it continues to be adopted.

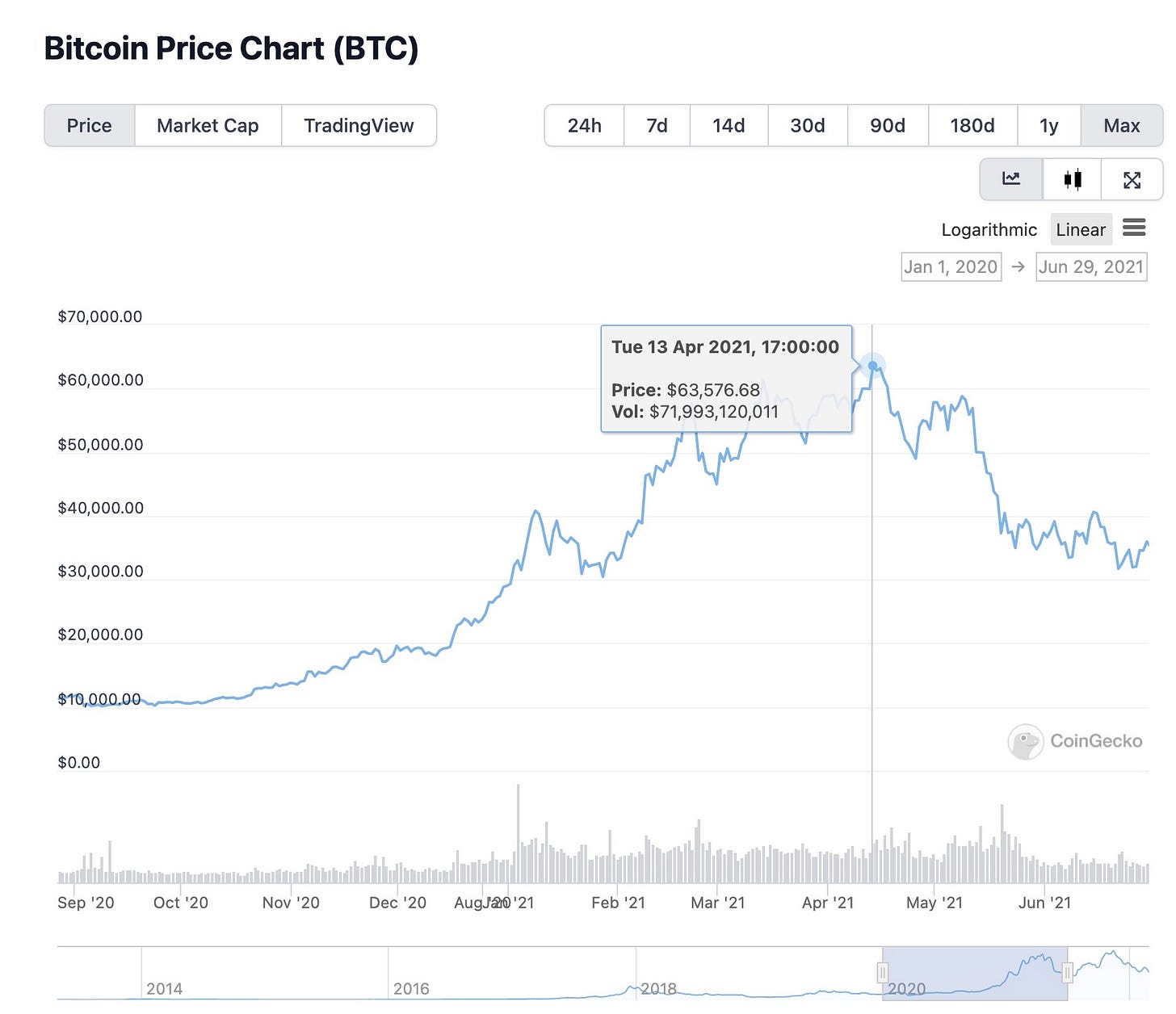

Here’s Bitcoin again in 2017.

After the 2017 bubble popped, I lived through the dark ‘crypto winter’, when Bitcoin dropped from $20,000 to $3,000. Many of those that came into Bitcoin for the first time and were unaware of what money was, the history of money, or Bitcoin’s superior monetary properties, likened it to bubbles of the past.

Some sold the bottom, and as Schiff warns, they did get rekt. But those who held through the dark winter were redeemed once again.

I never sold a single satoshi during crypto winter, because I, like many, believe that Bitcoin is the greatest form of money ever discovered. I was rewarded for it.

Schiff mentioned that this is all just one big extended bubble, but it seems to me that history would beg to differ. The Bitcoin bubble has popped many times in the past, and continues to relate, which profoundly differs from other bubbles.

I’d love to chat with Peter on this subject, and better understand how he can claim that a bubble with no intrinsic value can relate countless times, seemingly denying the laws of historic bubbles.

I’ll leave it up for you to decide for yourself whether or not Bitcoin is in a bubble this time around, and, given a long enough time horizon, if it will inflate once again.

Remember that nothing I say is financial advice and that these are just my opinions and conclusions, and I could be wrong and everything could go to zero as Schiff believes it will.

Schiff has a longer history of studying markets than me and you shouldn’t trust some guy on the internet, but instead I implore you to do your own research to come to your own conclusions.

Feel free to drop your thoughts in a comment. If you found this post interesting, please share it.

Thanks for your attention.

Alec