The Bitcoin City of the Future

My biggest takeaways from attending the PlanB Conference, and a Bitcoin start up investment that I'm syndicating.

Note: If you’re reading this in an email, the post may be cropped. Click “View Entire Message” to continue reading.

Francesco Madonna picks me up at the train station in Lugano, Switzerland. I am here to attend the PlanB Bitcoin Conference in the city he claims is “The Bitcoin Capital of Europe.”

It’s been two years since I attended a Bitcoin conference (Pacific Bitcoin in Los Angeles), and I’m excited to hear about the latest happenings and experience this incredible Bitcoin city firsthand.

We park in a structure nearby and stop for coffee at a bar just outside the event. When the bill comes, Francesco pulls out his phone and pays in Bitcoin.

Powered by the Lightening Network (a solution built on top of Bitcoin allowing for faster transactions and instant settlement) this payment was immediate and nearly free.

“Lugano has become a new home for Bitcoin,” he tells me. “More than 400 merchants accept Bitcoin here.”

Join our growing community of 34,000+ and enjoy a dose of insightful and practical content that will empower you to achieve financial wellness and optimal health.

For context, Lugano is a city of 63,000 inhabitants. As I would soon learn, 20,000 of them have a crypto-based wallet.

One of those new residents is Francesco. He has relocated from Italy to live with like-minded people in a city that is making an effort to attract Bitcoiners.

I can’t say I blame him. Although Lugano rests on a beautiful lake where one side is Italian (in Campione) and the other in Switzerland, the stark contrast between the two jurisdictions and their approach toward Bitcoin cannot be greater. Italy has recently raised the tax on Bitcoin capital gains to 42%. In Lugano, it’s zero.

What’s more, Lugano offers a 10% discount for people who pay in Bitcoin. They view it as a marketing expense to attract Bitcoiners to relocate to their city. Bitcoiners bring capital, spend money, and start businesses, helping the economy flourish. Apparently, it’s working.

Francesco has recently brought with him his Bitcoin start-up, BitVaulty, but more on that in a minute.

Highlights from the PlanB Conference

The PlanB Conference is filled with prominent Bitcoiners. Spread across 5 stages and two days, it’s a Bitcoiners paradise. Few people talk about price predictions. These are hardcore HODLers.

They have been severely “Orange Pilled”, a play on the famous scene from The Matrix to describe people who have ventured down the Bitcoin rabbit hole to learn more about the orange coin.

While it’s probably true that everyone hopes to increase their wealth, they can do that from home. What brings them here is to talk about the vision that Bitcoin promises: freedom, sovereignty, predictability and fairness. No shitcoins are allowed.

Adam Beck on a panel speaking about Bitcoin. Many believe he’s Satoshi. He denies it.

Over the two action-packed days, I see multiple incredible talks, including Adam Beck, the inventor of proof of work and many believe is Satoshi himself, speak about the future of Bitcoin. Dennis Porter discussed regulation, Natalie Brunell and Jack Mallers talked about global adoption and the benefits of Bitcoin for humanity, and Nick Sbazo, who invented smart contracts, gave a talk on the origins of money.

The Unique Bitcoin Start Up I’m Investing In

I also see several start-ups demo their Bitcoin service products, including wallets that use biomarkers to help you recover a lost key, a decentralized lending platform that allows you to borrow against your Bitcoin, and a credit card that allows you to securely hold and spend Bitcoin.

Then there is Madonna’s product, BitVaulty. It’s just what it sounds like, an unhackable vault that allows people to safely store their Bitcoin. Think of it like a bank vault for your coins.

Users set a mandatory time delay before they are allowed to move their Bitcoin, creating a foolproof system that prevents hackers and robbers from stealing their coins. Even if someone puts a gun to your head, they can see that the transaction cannot be processed for up to 15 days.

In the meantime, a notification is sent to a trusted third party, alerting them a transaction has been broadcast. That person can cancel the transaction and send for help. This makes robbery nearly impossible.

Their ultimate goal is to go after the 130 billion dollar cyber security market. Using Bitcoin vaults as a case study, they see a future where mainstream companies license their software to prevent hackers from stealing sensitive data.

They achieve this by utilizing the timestamp on the Bitcoin blockchain, which, if you think about it, is the most decentralized and immutable source of time in the world. Companies who leverage this software, powered by time delays and the multiple keys required to unlock data, can rest assured they can never fall victim to a security breach.

I love the last product so much I am syndicating it for my latest deal. DM me or email me at cryptorelli@gmail.com if you’re interested in learning more.

Lugano commemorates the pseudonymous inventor of Bitcoin, Satoshi Nakamoto with a disappearing statue.

I go all out for two days straight, putting in 10-hour days and doing both lunches and dinners with people I connect with at the conference. It’s an incredible time.

The Bitcoin City of the Future

It was not until the last talk of the last day that I saw Paolo Bartolin speak, the Deputy Chief Financial Officer (CFO) of Lugano. His vision is to set a European standard for cities to adopt Bitcoin. What he’s been able to accomplish is truly incredible.

“Politicians in Lugano aren’t here for the politics,” Francesco tells me as we sit down to watch the presentation. “They work to make a change. Most of them have other jobs.”

Bartolin gives a simple, concise, and straightforward talk on how Lugano became a Bitcoin city. They began by integrating financial services such as PostFinance, the leading payments platform in Switzerland, to create invoices using QR codes, which can be paid in Bitcoin.

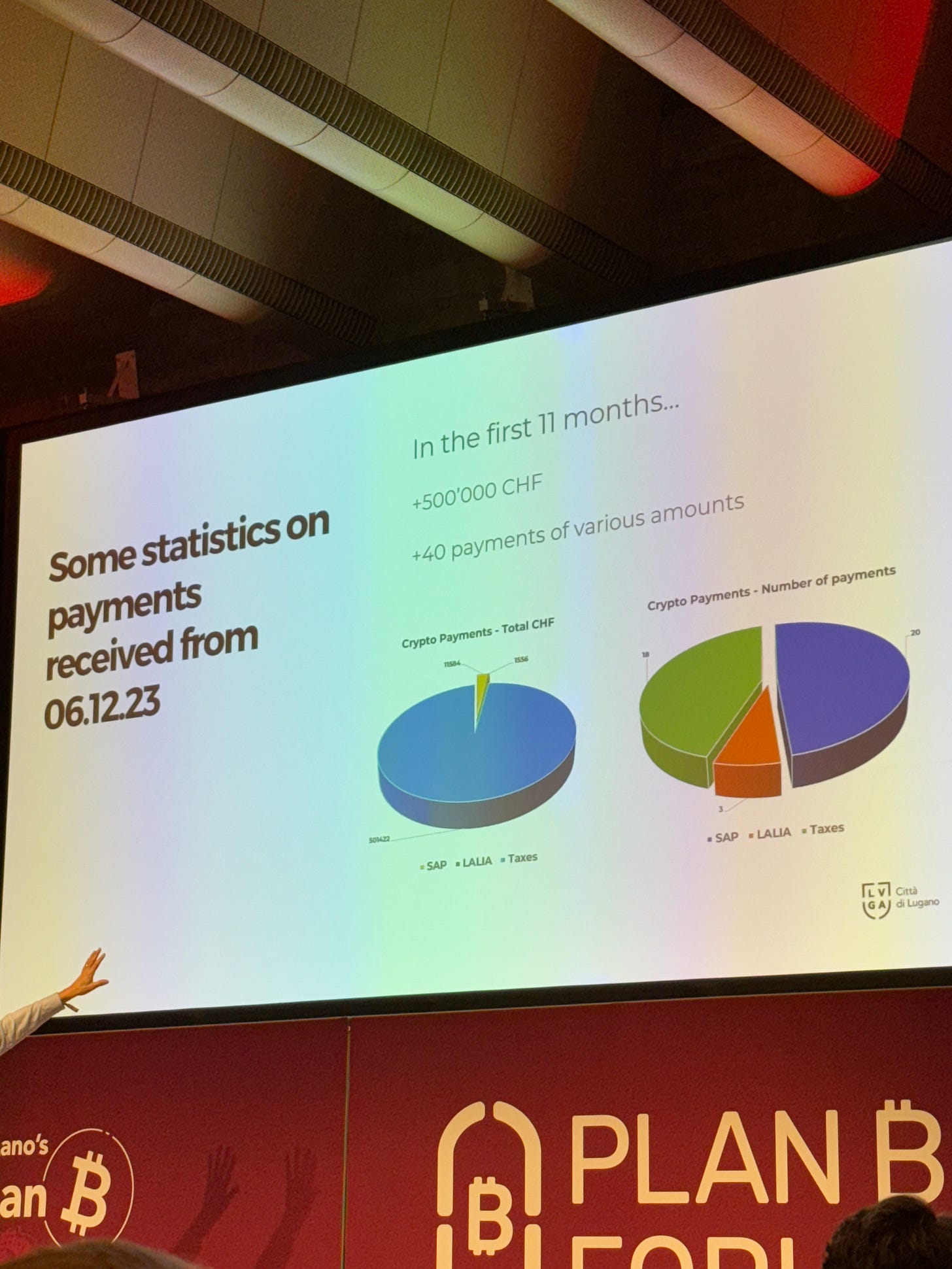

Lugano issued 300,000 invoices totaling 400M CHF in 2023 alone. Citizens can pay for everything from city permits to their taxes using Bitcoin and there are no limits on the size of transactions.

Behind the scenes, Bartolin utilizes Bitcoin Suisse, a prominent Bitcoin based bank, which converts the received Bitcoin back to CHF. The entire system is automated. Bartolin has offered this as a model for other cities to adopt and is available to assist in onboarding them.

You may be wondering if Lugano is truly a Bitcoin city, why convert the Bitcoin back to CHF? Why not hold Bitcoin in their treasury, like MicroStrategy does?

Bartolin is trying. Swiss law states that no assets can be held which are for “speculation purposes”. The law doesn’t explicitly state that Bitcoin is a speculation, but it doesn’t state that it’s not either. Stuck in this legal grey area, Bartolin is awaiting clarity.

But he has a plan. In the meantime, he’s encouraging citizens to pay for services in Bitcoin. He will then be able to turn around and pay his suppliers in Bitcoin. He believes that a strong Bitcoin payments system will allow him to make the argument that Bitcoin is not a speculation, but rather a necessary means of transacting. This will be the catalyst that allows Lugano to hold it in their Treasury.

His argument makes sense. “We can accept payments in Euros, and we aren’t forced to convert that back to CHF. Bitcoin, like Euros, is just another form of money. I don’t see a reason why we couldn’t hold it in the treasury, especially if we merely accepted it as a payment method instead of purchasing it directly.”

With the help of Bartolin and others, Lugano has made further steps to ensure it’s a haven for Bitcoiners. Here are just a few of the impressive facts about Lugano.

Switzerland has issued a nationwide proposal to preserve the right to transact in cash as a constitutional amendment, ensuring citizens have a right to privacy. Lugano takes this a step further by encouraging Bitcoin usage.

Lugano has partnered with Naka, a company which converts your stored Bitcoin to fiat when you need to spend it. It’s seamless and accepted by most merchants.

There are no capital gains on Bitcoin.

400+ merchants accept Bitcoin. 20,000 residents have wallets.

Lugano has partnered with Tether, the world’s largest stablecoin and third-biggest cryptocurrency, to accept USDT payments. The CEO of Tether is a Lugano resident.

Lugano is home to several Bitcoin startups, including BitVaulty, Elysium and Firefish

The minimum wage is 3,800 CHF ($4,386) and the average salary is 6,000 CHF ($6,926).

Ultimately, Lugano is on its way to adopting a Bitcoin Standard. The next step is to use Bitcoin as a store of value, but ultimately a broadly used medium of exchange, and eventually, a unit of account. They are paving the way for others in Europe to follow suit.

Their inspiring forward-looking stance is a testament to what a few people with a strong vision can accomplish, and the power of Bitcoin to unlock the greatest financial revolution in human history.

As for me, it’s time to depart. I’m off to Ireland to speak at EDGE on the future of online poker in the age of AI, host a meet-up cash game, and compete in the Irish Poker Tour.

“How far is the train station from here by car?” I ask the woman at the front desk.

“It’s very close. Six or seven minutes at most.”

I book a taxi for 9:45 am and head out for a run on the lake. I stop once more by the Satoshi statue to honor the inventor of one of the greatest scientific discoveries of our time.

When I arrive at the station, the cab driver holds up three fingers. “It’s 3 euros,” he says in broken English. I’m shocked. Nothing is this cheap in Lugano.

I have a few Francs left and hand it to him. He laughs, pointing to the meter.

“Thirty Euros”, he says. It’s a good thing they only pay 15% tax, have high minimum wages and there are no capital gains on Bitcoin. Life here is expensive.

Although it’s tempting to download a wallet and participate in the economy of the future, I don’t keep any crypto on my phone for security. (If you do, consider it like cash. You never want to keep more than you need to spend on that current day).

Nevertheless, I’m curious. “Do you take Bitcoin?” I ask.

“I do, but I’m fixing my device reader,” he says.

“It’s fine,” I say, pulling out my credit card.

Even if I did have Bitcoin, why spend it when I can get rid of fiat instead?

I hope you enjoyed this. Reach out to connect.

Alec