I extend a warm welcome to all new subscribers!

Join our growing community of 27,000+ and enjoy a weekly dose of insightful and practical content that will empower you to achieve optimal health and financial wellness. It takes just a second to sign up, and it's completely free.

Trading Overview

My goal is to outline what I’ve learned from trading and investing in previous crypto cycles (2017 and 2021) and improve my investment strategy for the next one. While I’ll share that with you today, this is very much a ‘note to self’ post that I can reference later when I’m tempted to sway from the path.

Notably, my strategy is not investment advice, but what works for me given my risk tolerance, starting capital, knowledge, skills, and desired lifestyle. Naturally, this may not work for you. Be conscious.

Watch the video version of this post instead

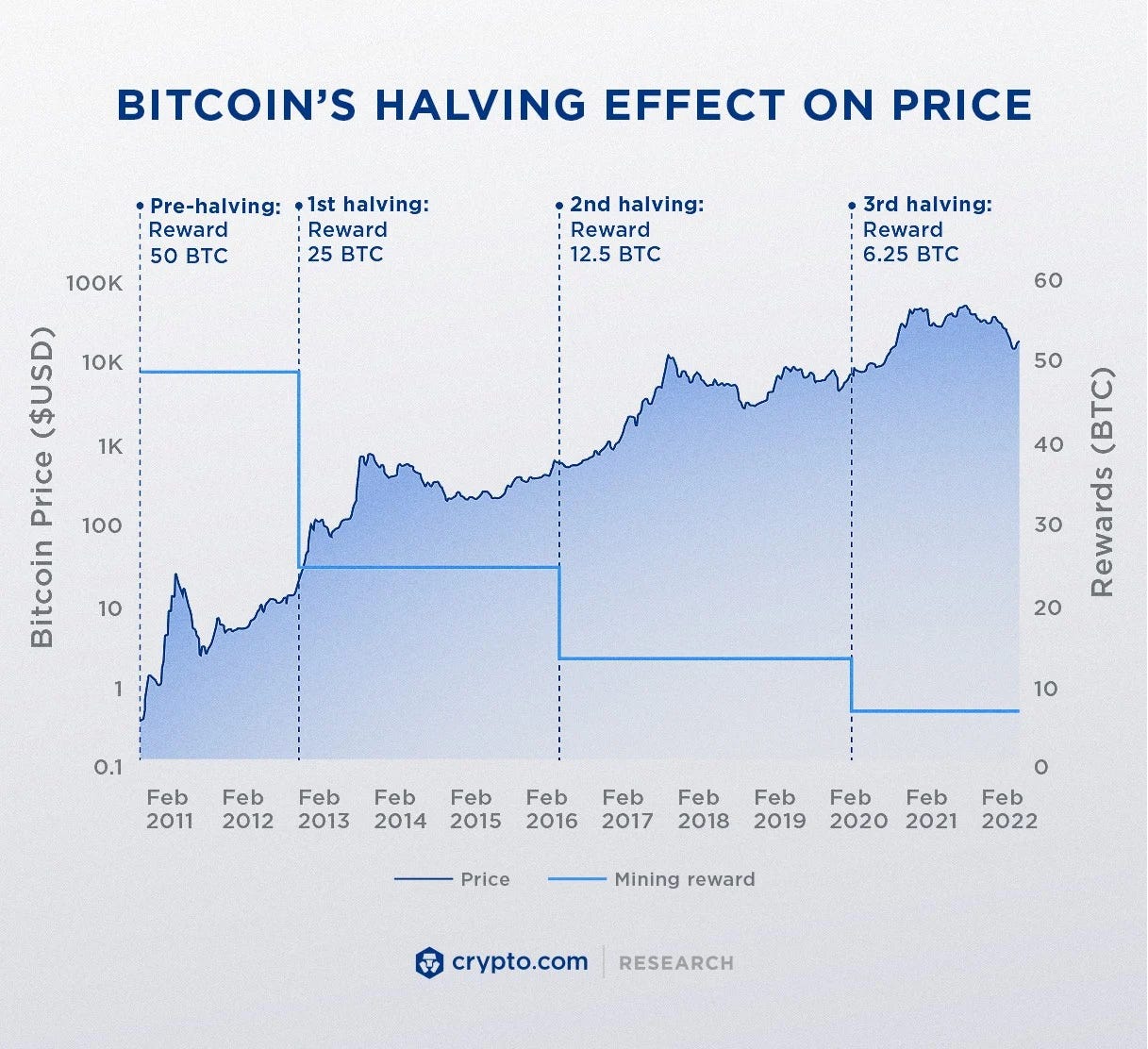

Bitcoin moves in ‘cycles’, which is a result of the issuance rate of Bitcoin being reduced by 50% every four years. Referred to as the ‘halving’, this has historically been extremely bullish for the price of Bitcoin.

When Bitcoin rises, the rest of the crypto market follows. This is the basic premise on which I’m investing during the next cycle.

Lessons From Previous Crypto Cycles

I’ve learned a lot since I first began investing in crypto. I’ve extensively outlined my thesis in The Future of Money, which details the reasons behind why and how Bitcoin will become the global reserve currency.

Coming from this fundamental belief, I feel it will produce the best long-term, risk-adjusted returns. Put another way, if I were forced to hibernate and could only bet on one asset, it would be Bitcoin.

That said, since it has the largest economic mass in crypto, and the rising tide raises all boats, I don’t believe it will produce the best short-term returns. Therefore, I speculate further down the risk curve on alts (shitcoins), and trade them to ultimately acquire more Bitcoin. This is risky, and not for everyone.

Notice the distinction between ‘trade’ and ‘invest’. The former is a short-term speculation whereas the latter is a long-term store of value.

One of the core lessons I’ve learned is that Everything is a Trade. I’ve always been clear about my strategy that I don’t intend to hold any of these coins, but rather trade them for Bitcoin (or stables) when I believe they are overbought, or we’ve reached the end of the cycle.

This approach took me down the crypto rabbit hole, and a lot of my time during the previous cycles was spent trading. While it was fun and profitable, and I learned a lot, I believe my energy is better spent elsewhere. In the next cycle, which I believe is already underway, I will zoom out and shift my focus to the macro big picture.

The Only Two Trades That Matter

This cycle, I’m only making two primary trades: one when I enter the market and another when I exit.

Naturally, I will ‘miss’ the local tops and bottoms that come with the highs and lows inherent to a new monetary commodity bulldozing its path to replacing the dollar.

For example, I’m not looking to ‘buy the dip’ when the SEC cracks down on alts, nor am I looking to ‘sell the hype’ when Blackrock applies for a Bitcoin ETF.

Although I’m aware these are often temporarily oversold and overbought signals, opening a window to profit with a quick trade, the time, energy, stress, and management it takes to continually follow the news is a distraction from my life goals, and no longer worth the incremental gain.

Therefore, my two trades are when to enter the market as a whole, and what to buy, followed by when to exit and what to sell.

The Next Crypto Cycle

I believe the current crypto bull run is already underway, albeit at the beginning stages. Just like in a poker game, to better understand how I want to improve, I must reflect on my play thus far. Looking back, while I was far from perfect, I’m proud of how I played crypto.

I began selling in December of 2021, near the top. I didn’t time it perfectly, of course, but avoided most of the downturn.

My trading partner Harrison and I went public with our thoughts shortly after, breaking down our macro view for the year 2022 both in my newsletter and on YouTube. We called for a crypto drop to the $20,000s, a contrarian take which paid off.

Of course, this was a tactical trade, and the point was always to be max long, as I believe Bitcoin is the best investment in the world.

While I also missed the bottom in December, thinking we’d go lower, I corrected course and ended up piling into the crypto market when Bitcoin was $20,000 back in March. I entered the alt market too then, which I’ll describe more below.

This marked the first part of my trade: when to enter the market.

I then sold a few days later when Bitcoin pumped to $24,000, only to get back in at $26,500. The back and forth was the straw that broke the camel’s back, and I decided that on the next catalyst, I’d pile in and be done.

That catalyst was the recent SEC debacle last week, which allowed me to scoop up Bitcoin and alts at extremely low prices. Thus far, things have gone well. Most alts are up ~25% of their lows. For example, I bought Avax at around $10 (it’s now $13), and Aptos at $5.90 (it’s now $7.50). A good buffer is always nice.

Some mistakes I made in the previous cycle were going too deep into the weeds of a token’s vision, community, roadmap, social media, etc. While that’s not only a distraction, it can easily lead to biased decision-making. This cycle, I will keep my focus high level.

What I’m Buying and Why

When considering about what to buy, I only have one criterion: which tokens will appreciate the most with the least likely chance of going to zero.

Since everything is a trade, and 99% of alts will ultimately fail, I’m just looking for what will pump during the next bull market. People may dislike my approach, but I’m a realist who has lived through multiple cycles and seen this play out time and again. I wish it weren’t this way, but an imperative aspect of being a good investor is betting on how things are, not how you wish they were.

So, why does something pump?

One word: hype.

Crypto is all about narratives. A token needs great marketing for the public to catch on and be deluded into believing it will be ‘the next big thing’.

While having a roadmap is important, delivering on the roadmap is not. I, and most likely the token itself, will be long gone before their five year ‘vision’ comes to fruition.

I would rather acknowledge the reality of the current crypto market, where 99% of cryptocurrencies are deemed ineffective and underperform Bitcoin in the long run than entertain delusions of $PEPE making me wealthy in the long term.

So, the only question on my mind is, what are the future trends?

In 2017, it was all about DeFi.

In 2021, it was Layer 1’s (known as “Eth Killers”), such as Solana and Avax.

What’s next?

Aside from Bitcoin, Ethereum is the next safest bet, the silver to Bitcoin’s gold.

I have some, but that’s not why you’re here.

As I’ve written, I believe Play to Earn (crypto gaming) has the potential to be one of the biggest niches within crypto, with a real use case.

AAA Play to Earn games will be released, accessible in VR/AR. While I’m sure some individual games will produce a 10,000x like Axie, I’m not looking to bet on a random lottery ticket, but rather ride the wave up as the entire industry rises.

I like the ‘safer’ bets like Gala, Illuvium, and Immutable X, which are more infrastructure plays, where their success is less contingent on the outcome of one individual game, but rather the industry as a whole.

Second, I’m looking for ‘the next Layer 1’s’ which the market believes will ‘disrupt Ethereum’ and ‘Layer 2’s built on ETH, which will allow it to scale.

For the former, I like Avalanche (Avax) as a ‘safe’ bet, and Aptos for something further down the risk curve. For the latter, Matic (polygon) is my safe bet, while I’m also speculating on Arbitrum and Optimism.

I particularly like Arbitrum and Optimism because they’ve never experienced a bull run, and therefore have more potential to be ‘the next big thing’.

I still have a small amount of HEX that is ladder staked, which I hope will do well during a bull market.

Finally, the only altcoin I’m actually somewhat bullish on that could have long-term value is Unit Network. I still have my core allocation and will hold it until it moons or dies.

As for my portfolio split, I intend to keep the alts around 30% of my overall crypto portfolio, split across the above.

When I’m Exiting Crypto and Why

At the top, of course. But what does that mean?

While there are many projections for when and at what price, the truth is, I have no idea. I’m less concerned about the date or dollar amount and instead focused on the patterns and signals.

At the peak of the last cycle, in December of 2021, I attended a Christmas party. A real estate agent by day, “John” and I struck up a conversation. Midway through, he received a notification. An NFT was dropping and he ‘had to mint it’.

Right now, or else he wouldn’t get in.

This JPEG of a chicken ‘had utility’ because it could ‘lay eggs’, giving you other ‘free’ NFTs, all of which of course would skyrocket in value.

Around that time, my Uber driver told me about how he had discovered a new token, a meme coin of course, that ‘was going to be the next Doge’.

Crypto came up during dinner parties, and friends who never asked were beginning to get curious.

Celebrities were piling in, and talk show hosts were bragging about their Bored Apes. Pictures of JPEG rocks were selling for hundreds of thousands of dollars.

It was time to sell.

Looking back, these were the most obvious top signals one could imagine. While they will vary in specifics during this cycle, such extreme greed, and inebriation with getting rich will be present.

At that time, I’ll sell 100% of my alts and the trading portion of my Bitcoin, keeping only my core position (which I’ve never sold since I first invested in 2017).

I’ll then wait a year until the media and mainstream proclaim ‘crypto is dead’, and start the whole thing over.

I’m not sure how many more cycles we have until hyperbitcoinization, the phenomenon which predicts that all fiats will die and Bitcoin will become the global reserve currency, (although I believe we still have one more after this), but what I am confident about is that we at least this one, and so I’ll cross that bridge when I come to it.

Where Are We Now

Bitcoin has made immense progress. The highs of the previous cycle became the new lows of this cycle.

Right now, it seems to me we are where Bitcoin was back in 2018 when it was hovering around $6,000. Whether it would drop further to $3,000 or run up to $70,000 was anyone’s guess, but zooming out, it really didn’t matter.

The same is true of today. We may pull back to $20,000, or the bottom may already be in, but when we look back at the top of this cycle when Bitcoin is over $100,000 per coin, (and more likely at $200,000+), and alts have done a 20-100x, none of it will matter.

What will matter is whether one allocated an appropriate amount and had the mental fortitude, discipline, and risk tolerance to hold all the way through, and, in the case of 99% of alts, sell before they go back to their intrinsic value, zero.

Put another way, making two trades is exponentially harder than making 200, simply because you have to hold at a 2x, 3x, 4x, 5x, 10x, and 20x to make a 50x, and then sell before it all comes crashing down.

Most fail to do this. In fact, they do the opposite. Nobody wants to buy alts right now due to the latest SEC crackdown and capitulation that just ensured over the past year. That’s precisely why I’m long. To make a large profit, one must take a nonconsensus view, and be correct.

What most will do is ‘wait until it’s safe to buy,’ which of course is the riskiest time. Like my Uber driver and John minting JPEGs of chickens, this will be the top signal I’m looking for to sell.

As with every cycle, it’s easy to see this in retrospect, but being caught up in the daily noise is often a hindrance to achieving maximum gains. Most people don’t have the temperament to trade, which is why I believe that for 99% of people, simply buying and holding Bitcoin (and perhaps some ETH) is the best strategy.

If one chooses to trade, a solid game plan along with a delicate balance of staying informed while being mindful to avoid being sucked in will be paramount.

I expect this to be a several-year game plan, with the top coming somewhere in 2025 or perhaps even in 2026.

As always, I’ll know when we’re closer and keep everyone updated on how I’m playing it on here and on my Twitter.

How are you playing crypto and markets?